montana sales tax rate 2020

Some rates might be different in Montana State. Sales Tax Calculator Sales Tax Table.

Is Buying A Car Tax Deductible Lendingtree

The Montana sales tax rate is currently.

. The Montana state sales tax rate is 0 and the average MT sales tax after local surtaxes is 0. You can use our Montana Sales Tax Calculator to look up sales tax rates in Montana by address zip code. Five states do not have.

While the base rate applies statewide its only a starting point for calculating sales tax in Montana. The minimum combined 2022 sales tax rate for Butte Montana is. Combined Sales Tax Range.

2022 Montana state sales tax. Montana state sales tax rate. A City county and municipal rates vary.

368 rows There are a total of 68 local tax jurisdictions across the state collecting an average local tax of 0002. Add the local tax lets use 3 percent for this example. State Local Sales Tax Rates As of January 1 2020.

Before the official 2022 Montana income tax rates are released provisional 2022 tax rates are based on Montanas 2021 income tax brackets. An alternative sales tax rate of NA applies in the tax region Flathead which. To figure the tax on a room that costs 100 per night for one night add the two state taxes together for 8 percent.

Base State Sales Tax Rate. These rates are weighted by population to compute an average local tax. Montana has a 675 percent corporate income tax rate.

Local Sales Tax Range. The minimum combined 2022 sales tax rate for Bozeman Montana is. The Kalispell Montana sales tax rate of NA applies to the following two zip codes.

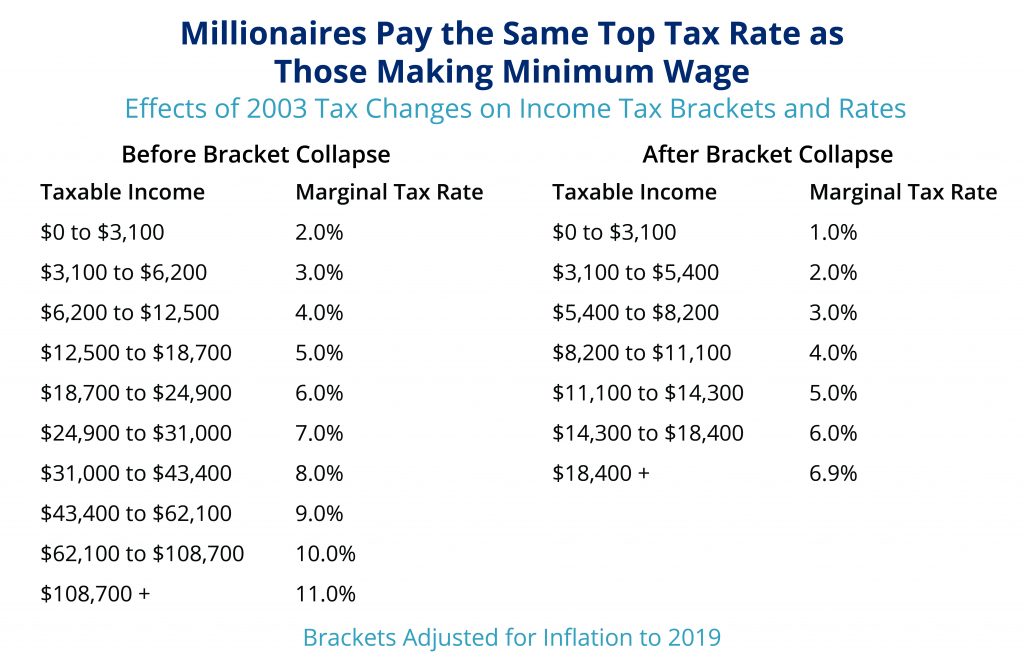

Montana Tax Brackets 2022 - 2023. 2022 Montana Sales Tax Table. Montana has a graduated individual income tax with rates ranging from 100 percent to 675 percent.

Proposal Notices MAR 42-1062 MAR 42-1062pro - pertaining to updates of the Montana Reappraisal Plan and. Base state sales tax rate 0. That is a total of.

This is the total of state county and city sales tax rates. Sales tax rates differ by state but sales tax bases also impact how much revenue is collected from a tax and how the tax affects the economy. The Montana State Tax Tables for 2020 displayed on this page are provided in support of the 2020 US Tax Calculator and the dedicated 2020 Montana State Tax CalculatorWe also.

The 2022 state personal income tax brackets. Department Rulemaking Activity for November 4 2022. The state sales tax rate in Montana MT is.

Get a quick rate range. Rates include state county and city taxes. Looking at the tax rate and tax brackets shown in the tables above for Montana we can see that Montana collects individual income.

Montana does not have a. Click here for a larger sales tax map or here for a sales tax table. The calculator will show you the total sales tax amount as well as the.

Exact tax amount may vary for different items. This is the total of state county and city sales tax rates. Montana Sales Tax Ranges.

The Montana sales tax rate is currently. 2020 rates included for use while preparing your income tax deduction. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the.

Montanas sales tax rates for commonly exempted categories are listed below.

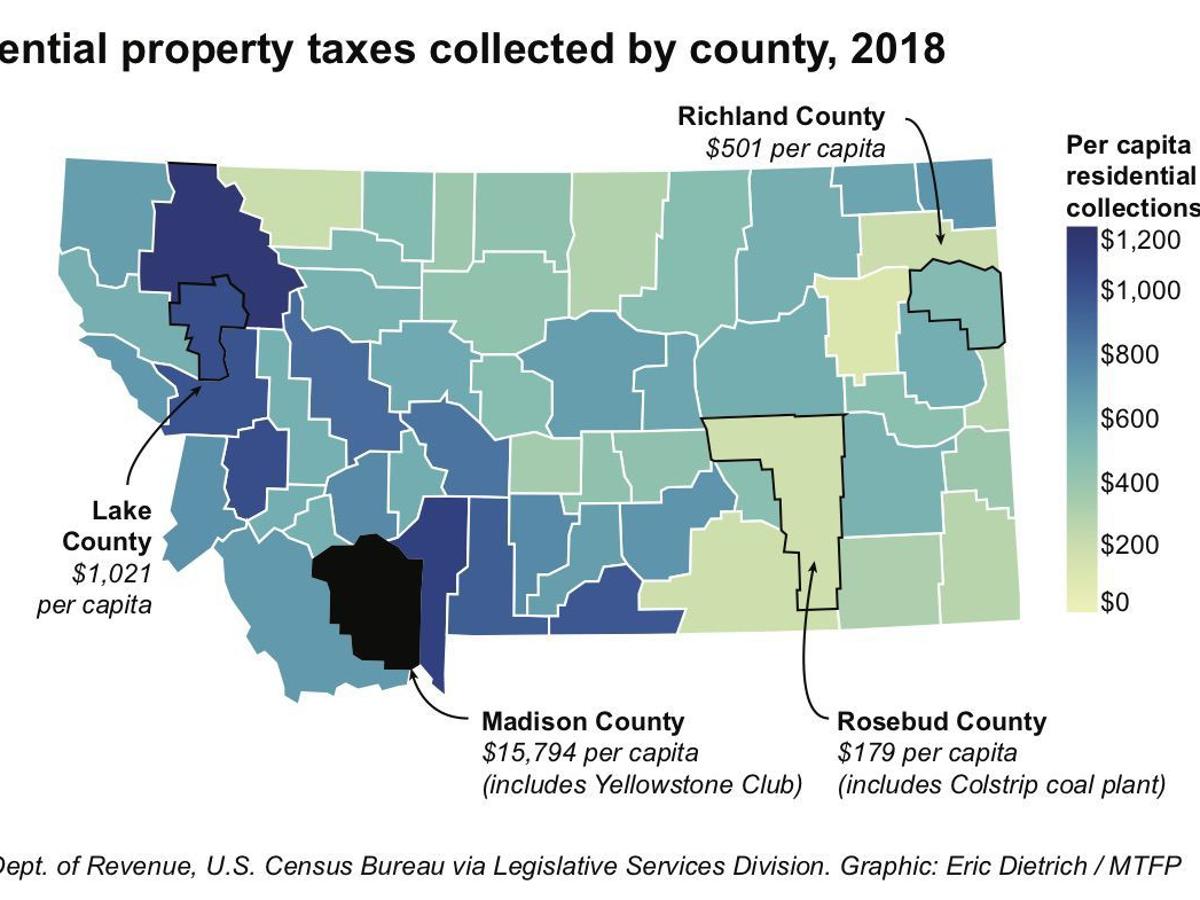

Ci 121 Montana S Big Property Tax Initiative Explained

Economic Nexus State Chart State By State Economic Nexus Rules Sales Tax Institute

Basic Information About Which States Have Major Taxes And States Fiscal Years

Lowest And Highest Sales Tax States Claruspartners

State Local Sales Tax Rates 2020 Sales Tax Rates Tax Foundation

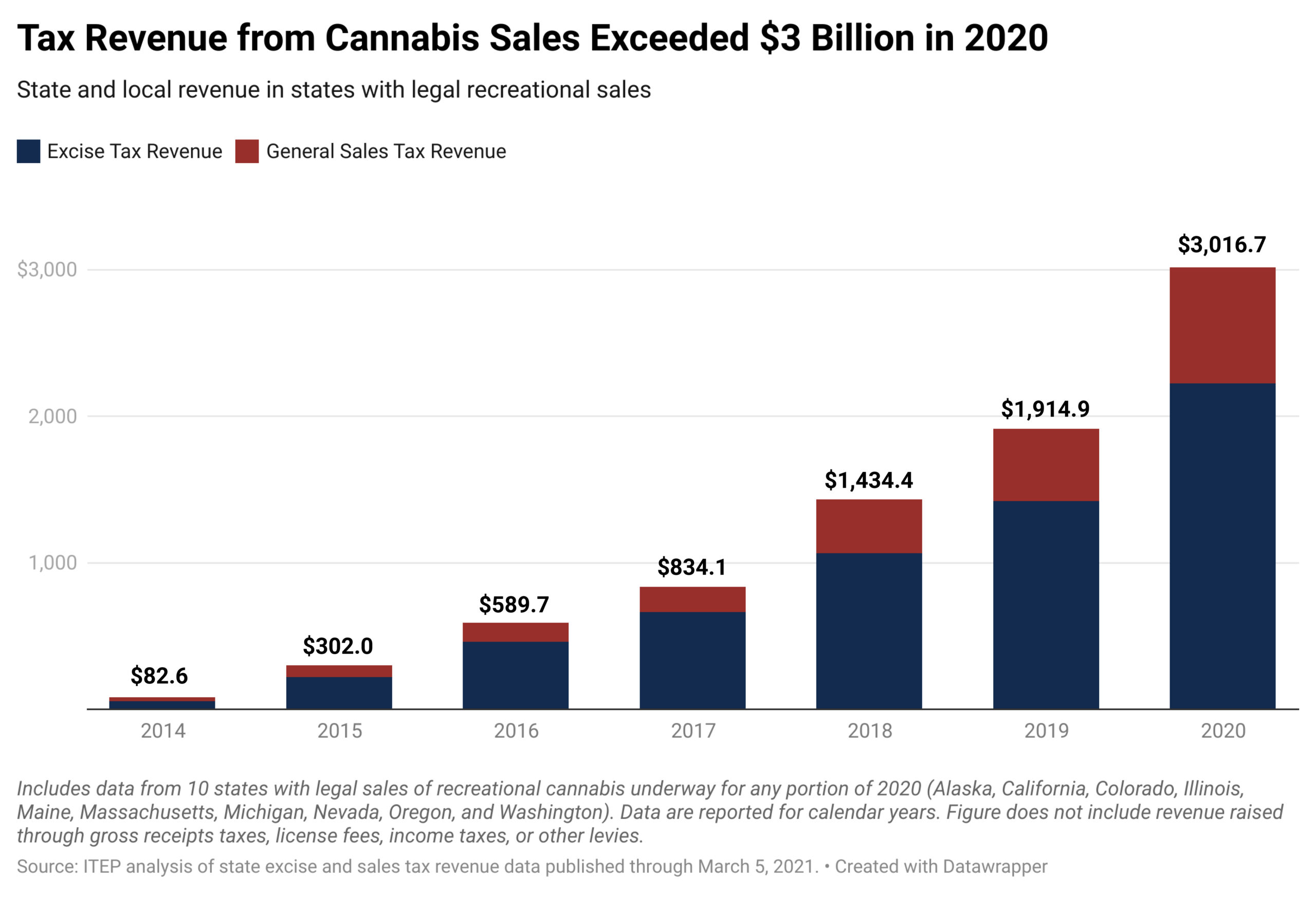

State And Local Cannabis Tax Revenue Jumps 58 Surpassing 3 Billion In 2020 Itep

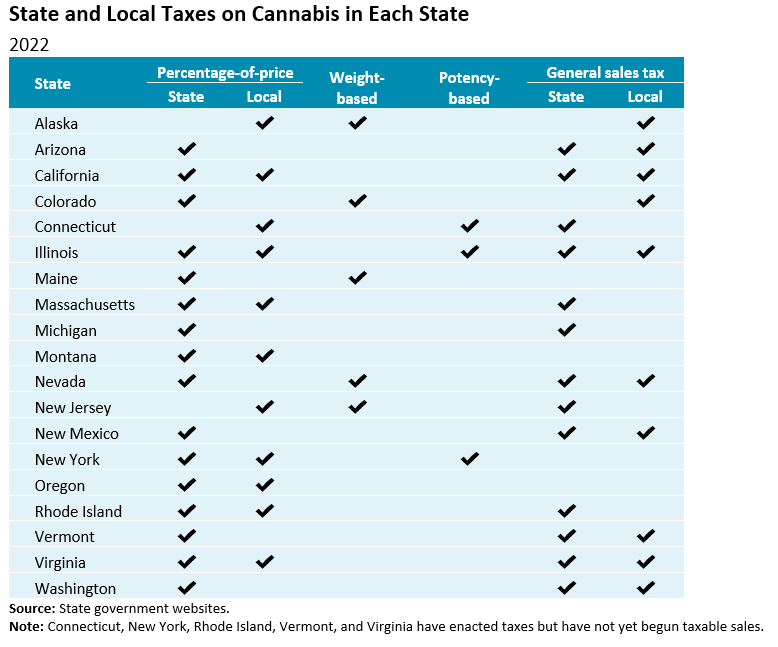

Cannabis Taxes Urban Institute

State Local Sales Tax Rates 2020 Sales Tax Rates Tax Foundation

Cannabis Control Division Frequently Asked Questions Montana Department Of Revenue

Washington Sales Tax Small Business Guide Truic

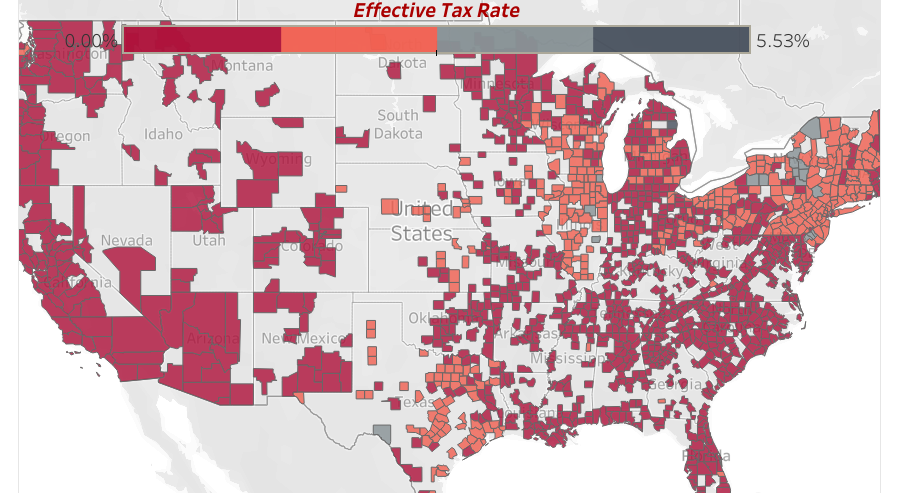

Montana Property Taxes Keep Rising Here S Where Residents Shoulder The Heaviest Loads News Bozemandailychronicle Com

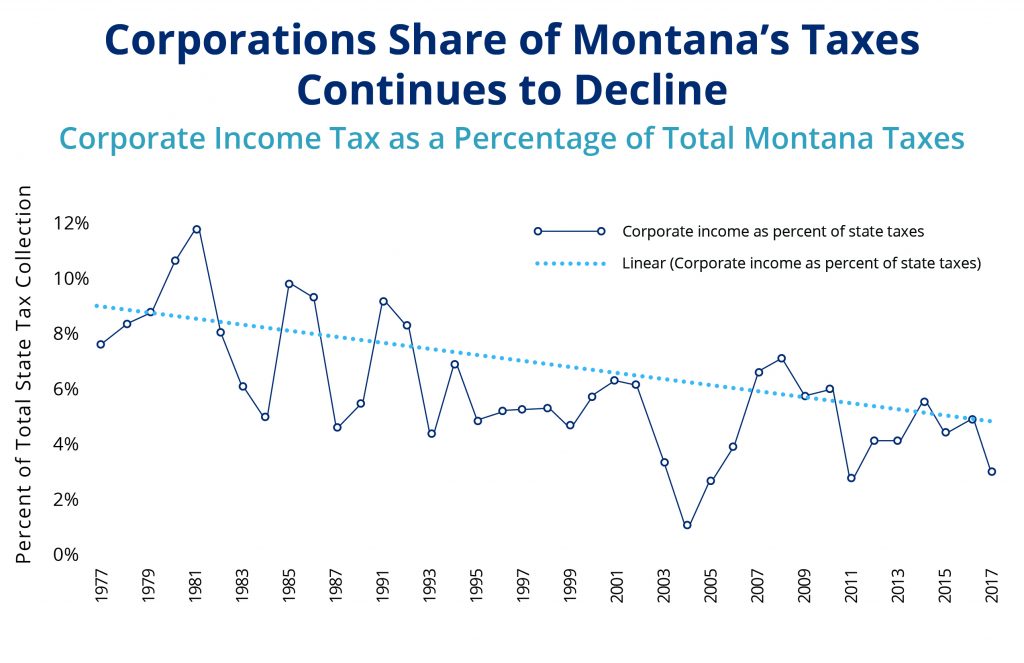

Policy Basics Corporate Income Taxes In Montana Montana Budget Policy Center

State And Local Sales Tax Rates Midyear 2020 Tax Foundation

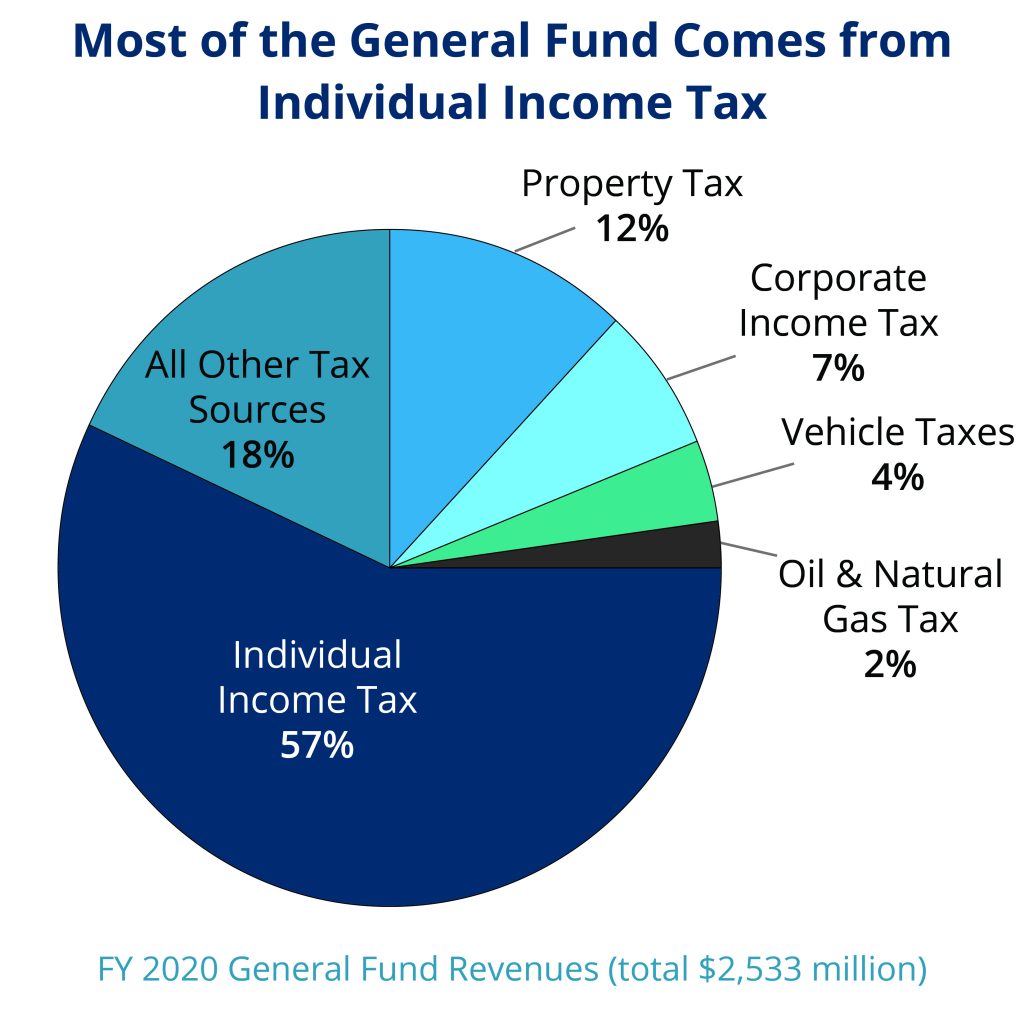

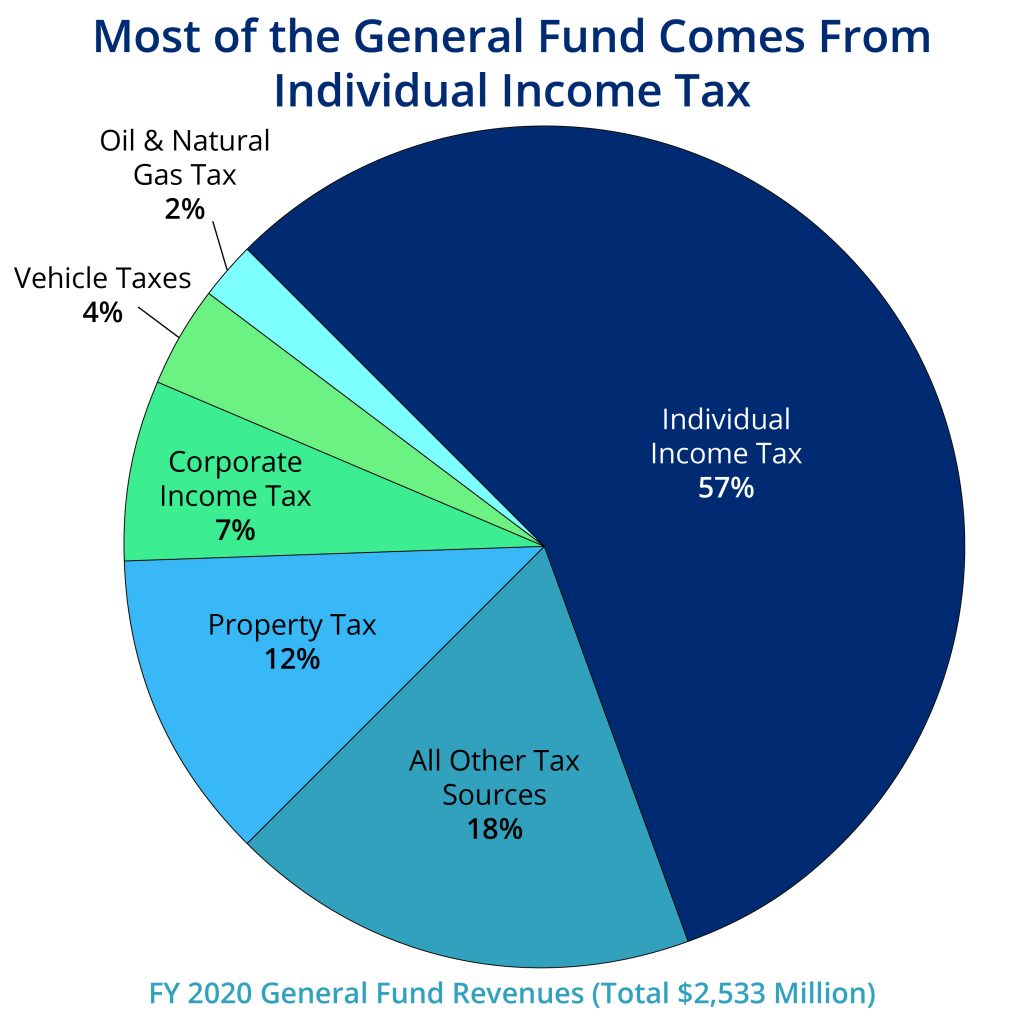

Policy Basics Individual Income Taxes In Montana Montana Budget Policy Center

Policy Basics Corporate Income Taxes In Montana Montana Budget Policy Center

Policy Basics Individual Income Taxes In Montana Montana Budget Policy Center

State And Local Sales Tax Rates Sales Taxes Tax Foundation

Property Taxes Levied On Single Family Homes Up 5 4 Percent In 2020 To More Than 323 Billion Dfd News

Sales Tax Rates Reached 10 Year High In 2020 Accounting Today